More about Bolt

NJF Capital presents Bolt. The rise of Amazon has led to the ecommerce giant gaining significant market share across the globe. All the other ecommerce companies are feeling the pinch, with margins continuing to be squeezed. On top of this, eCommerce infrastructure is currently fragmented and expensive. High commissions on payments processing, poorly designed checkout products and the high cost of chargebacks further reduce bottom-line profits for vendors.

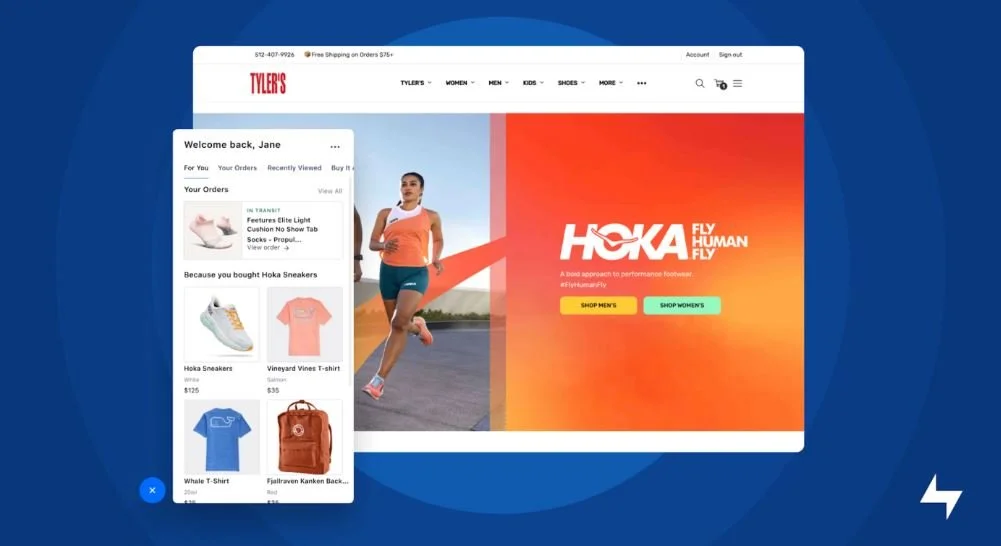

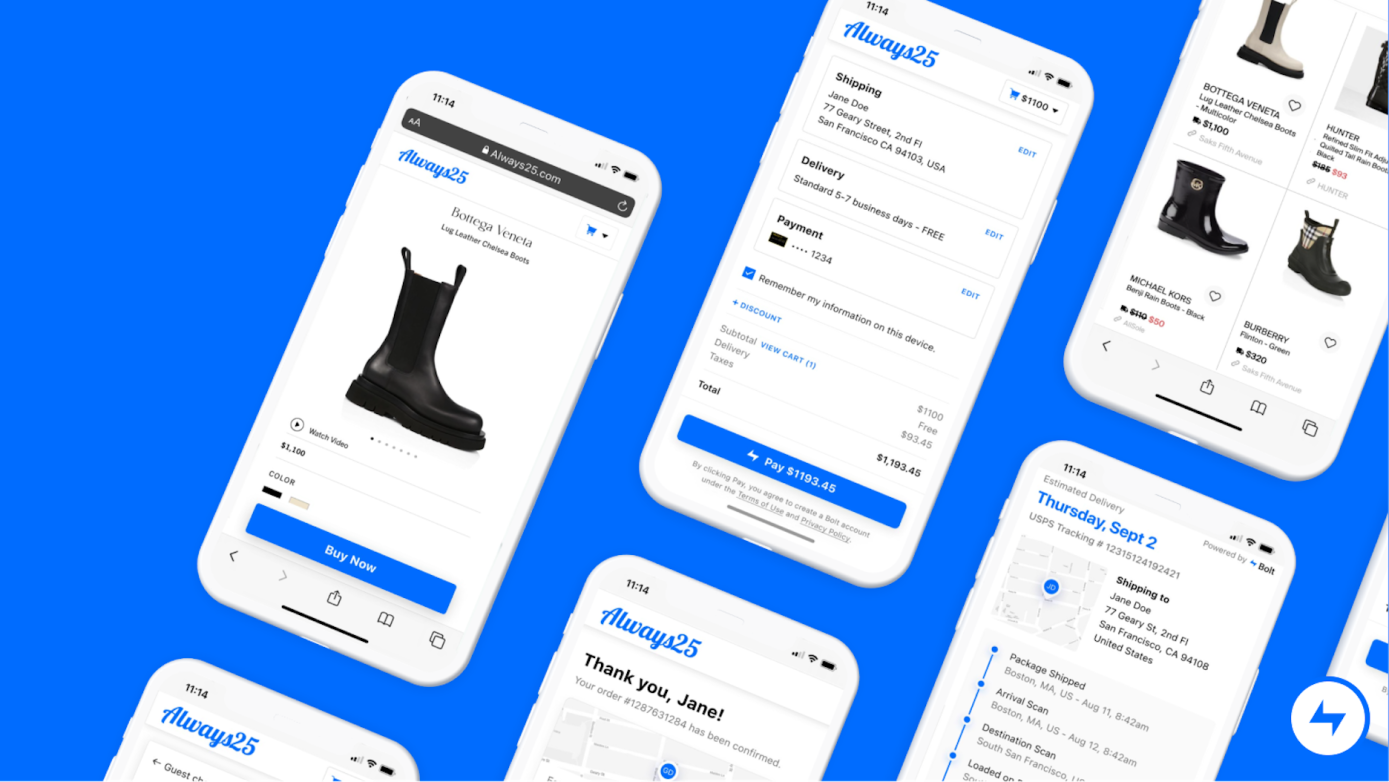

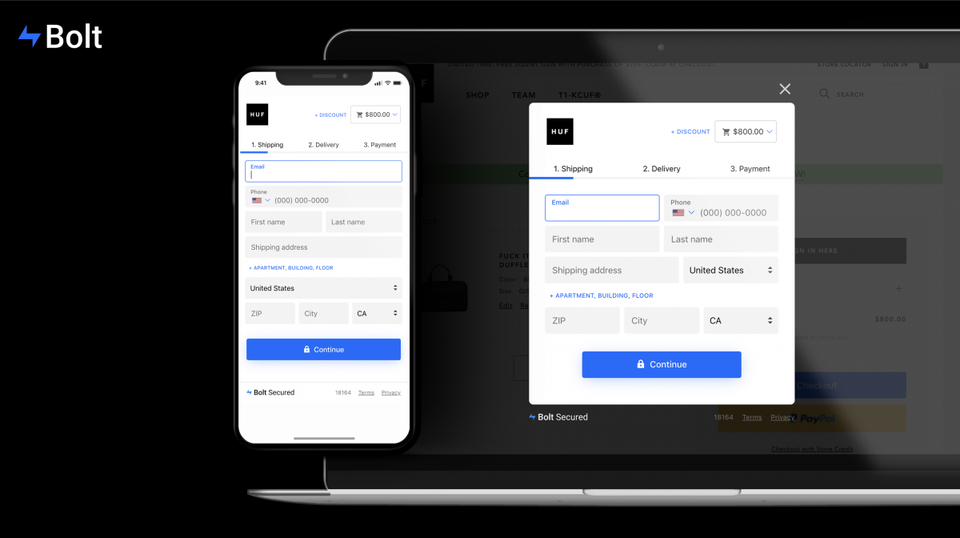

Bolt provides an end-to-end payments stack that drive e-commerce businesses 10-50% of newfound revenue. They increase vendor revenues by reducing the number of customers quitting the purchase process during checkout, via an improved user experience that requires less clicks, fewer fields and no redirects. As Bolt is performing the check-out and payment processing functions, the company has access to additional data during the entire process. This additional data leads to better models, more precision and lower fraud costs. Bolt passes on these saving to the merchants by providing 100% fraudulent chargeback coverage.

Bolt in the news

Bolt's new virtual Shopper Assistant can help retailers more easily turn guest shoppers into account-holding customers

The cash-and-stock deal for Wyre, founded in 2013, adds crypto payment capabilities to Bolt’s e-commerce checkout technology.

Bolt announces $355 million in Series E financing to give the company an $11 billion valuation

Bolt made its first acquisition in Tipser, a Swedish-based technology company enabling direct checkout on any digital surface.

New and follow-on funding in the Series D brings Bolt’s total funding to nearly $600 million

Bolt, which is developing a one-click checkout experience platform, brought in $75 million in additional funds for its Series C to give it a total round of $135 million

More than 60,000 BigCommerce customers can now access to Bolt’s holistic platform to easily manage and improve checkout, payments, and fraud protection

Bolt gives retailers and consumers more choice, control and flexibility over their transactions by managing the back end of the checkout

FinTech Magazine takes a closer look at one of the fastest growing financial software startups to emerge in the fintech space today, Bolt.

Partnership with Bolt will deliver seamless, conversion-focused checkout and fraud detection to stores on the Miva platform.